Ever heard the word 'account mutation'? Many of us may already be familiar with the term banking on this one.

As is the case with a checking account, account mutations are one of the important documents that you must have as one of the requirements. Starting from the submission of cash loans, and visa submissions, to tax reporting documents.

Whatever its interests, there is no harm in finding out more related to account mutations, ranging from understanding, and functions, to how to check account mutations that can be done in various ways. Let's look at more here.

1. What is An Account Mutation?

Account mutation is a term that exists in banking. This term means a list of transactions or activities that occur in bank accounts in a certain period, for example one month or one year.

Account mutations contain information about each transaction carried out by the account owner, such as credit, debit, and account balances that exist on a certain date.

Account mutations are often used by bank customers for various purposes. Starting from carrying out financial checks, ensuring all transactions carried out have been recorded correctly, up to proof of financial statements for audit purposes, tax reporting, or credit application in finance companies.

2. 6 Bank Account Mutation Functions

The main function of the account mutation is to provide detailed information related to the financial activities in your bank account.

The other important functions of account mutations are as follows.

2.1. Monitoring

The presence of account mutations can help you to check existing financial transactions on the account regularly, allowing you to ensure that the incoming and exit money is appropriate and valid.

2.2. Proof of Financial Transactions

If there are errors in the transaction such as incorrectly entering the account number, account mutations can help you identify the error so that it can be fixed immediately.

2.3. Manage Finances

Account mutations can make it easier for you to manage finances. Because by checking account mutations regularly you can find out all financial transactions that occur in a certain period.

From the breakdown of the data, you can do your own reflection on the way you spend money and make a better financial resolution.

2.4. Maintain Security

By checking the account mutations periodically, you can detect all suspicious forms of transactions and various other criminal acts.

2.5. Requirements for Applying for A Loan

Account mutations are one of the requirements that you need to attach when you want to apply for a loan to a non -bank financial institution or bank. By attaching proof of mutation in accordance with the specified period, the loan application process can run smoothly.

2.6. Requirements for Submitting A Visa

When going to make a visa, account mutations are often used as one of the mandatory requirements that you must attach. This is needed to ensure that you have sufficient funds to guarantee financial conditions as long as you are in a destination country.

3. How to Check Bank Account Mutations

There are several ways you can do to check account mutations. This depends on the bank and banking services that you use. Here are some common ways to check account mutations.

3.1. Bank Teller

How to check the mutation through a bank teller is quite easy. You can follow the steps below.

- Visit the nearest bank branch office

- Convey your purpose to the officer or security guard who is on guard

- You will be asked to take the CS queue number

- Wait a minute until your queue number is called

- Tell CS that you want to check the account mutation in accordance with the period you have specified

- CS will process your request

3.2. ATM Machine

Account mutations you can check using the ATM machine are as follows.

- Enter your ATM card on an ATM machine

- Enter your PIN Card

- On the screen displayed select the "Mutation Account" menu to see the latest transaction list

- Enter the date period you want to display

- Wait a minute until the data you ask for is displayed on the ATM engine screen

3.3. M-Banking

Banking technology is now increasingly sophisticated thanks to the presence of mobile banking applications that are ready to serve you, including account mutations. You can check the mutation in the M-Banking application by following the following guidelines.

- Make sure you have downloaded the mobile banking application according to the bank you use in the Play Store or App Store

- Enter the username and password

- Select the "Account Mutation" menu on the dashboard displayed. This menu you can generally find in the account information section

- Enter the mutation period you want to see

- Confirm the existing data by entering your PIN

- Wait a minute until the account mutation is displayed on the screen

3.4. Internet Banking

How to check account mutations via internet banking is not much different from mobile banking. The following stages.

- Visit the official bank site that you use

- Enter your PIN and Username

- Select the "Account Mutation" menu

- Enter the mutation period you want to see

- Wait a minute until the data you ask for is displayed on the screen

3.5. SMS Banking

Some banks also provide SMS banking services that allow customers to check account mutations via text message. You simply send a message in a certain format to the number specified by the bank.

That's 5 ways to check account mutations easily and safely. Make sure you check the account mutations regularly to ensure that all transactions have been recorded correctly and there are no suspicious activities in your account.

4. Differences in Mutation of Accounts and Current Accounts

Current Account and Account Mutations are two things that are interrelated in banking activities. Even so, there are differences between the two.

4.1. Mutation Period

The first difference lies in the existing mutation period. The checking account is an official document issued by a bank that contains a list of transactions conducted on the customer's account in a certain period, such as one month or one quarter.

Meanwhile, account mutations are a list of transactions that occur in the customer's account and are displayed with a certain time limit, generally only lasting for 30 days.

4.2. Information Displayed

The Check Account displays the initial and end of the account, credit, debit, administrative fee, and other information related to all financial activities in the account.

While the account mutation displays transactions that occur in a short account, such as credit, debit, transaction date, and account balance on a certain date. Account mutations can also be used to check the latest transactions and check the current account balance.

The main difference between the checking account and the account mutation is that the checking account is an official document issued by the bank to provide detailed information on financial activities in the customer's account, while the account mutation is a list of transactions that can be checked by customers at any time through banking services such as mobile banking and the like.

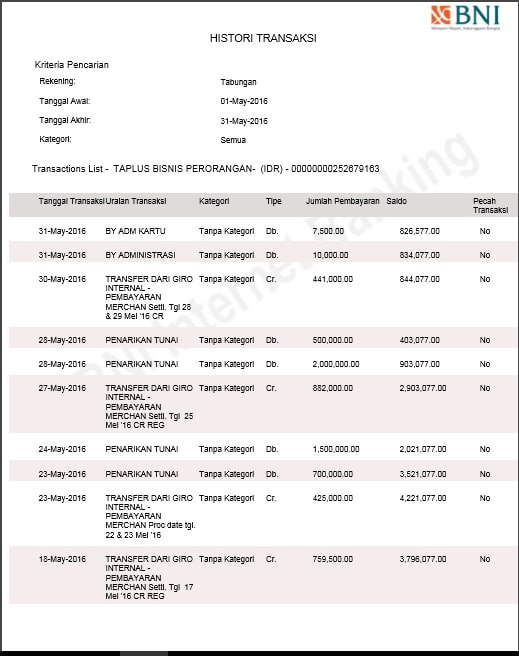

4. Example of Account Mutations

For those of you who don't know at all how the account mutation forms, below is one example of an existing account mutation at the bank.

Image Source: rangkulteman.id

Friend BFI, Thus the complete discussion related to account mutations is: understanding, function, and how to check. The hope, hopefully, this information can be useful for all readers.

Borrowing funds is easier and safer at BFI Finance! Get a loan of funds up to 85% of the assets guaranteed if the requirements are complete.

Click the link below for more information.

Get disbursement funds up to 85% of the value of vehicles and tenors for up to 4 years.

Get loans with a fast process and a maximum tenure of up to 24 months.

Low interest starts from 0.9% per month and has a long tenor of up to 7 years.